[TIP-16] Extension of LP Rewards & Updating of Pool Weights

-

Intro

All data shown in this thread wa collected from

2021-05-13 19:00:27.51635566 UTC +0:00, the time the last adjustment took place and includes data until2021-08-28 23:59:59.99999999 UTC +0:00to make a clean daily cut.Data can be accessed here.

This proposal consists of three sub-proposals:

- Extension of the Liquidity Provider rewards

- New Parterships Boost

- Pool weight adjustment

They impact each other and therefore I put them into one thread but will be executed in several steps on chain, if passed.

The proposed adjustments are not meant to be fixed for the next 6 months. Reconsidering the pool weights should be done on a regular basis like each 3 months.

Extension of the Liquidity provider rewards

The obvious first, which is a requirement for the next proposed steps. In my opinion there us no way around this to keep the markets tradable.

- Extend LP rewards to 30% of inflation value for 6 months, decreasing linearly each week to 20% for the last week.

Maybe higher since the value of SWTH dropped a lot.

Right now $29.337,07 are distributed to all pools with a pool weight each week. With a fresh 30% this will increase to $41.863,07 at $0,01842251 per SWTH.

With extending the liquidity provider rewards the ARP for stakers is expected to be ~23.63%.

New Partnership Boost

In order to get new users to Tradehub/Demex I suggest offering new projects a quite high boost for their markets. I propose to take 5 points equal to 5% total boost for new partnerships as long as they/or their community provide a certain amount of liquidity among all pairs including their token/coin.

Furthermore, a time limitation of 30 days ensure that new projects have a chance to get a good boost for their project. In my opinion project will only chose Demex as their preferred exchange if we provide them good reasons too. In exchange we aquire new and fresh users to Tradehub.I suggest following conditions to obtain the boost:

- min. Liquidity among all pairs: $100,000.00

- min. Liquidity per pool: $50,000.00

- Telegram + Twitter promotion to their user base

This is what I see we offer them:

- Exchange with orderbooks (Market, Limit, Stop, ...)

- High ARP since the provided Liquidity will be low compared to the received boost

- Support for the listing process(Validators already showed their willingness to create and fund the proposals)

If no other projects qualified for the next promotion month the boost can be removed/lowered or extended.

I am open for feedback and suggestions.

Pool weight adjustment

The following table shows each market, and their total volume share. This indicates important markets for Demex. As a help the current boost and the liquidity is added to the table.

An important ratio is the Volume per Liquidity, this indicates how much Volume($) was generated per Liquidity($). A high ratio may say that this market had could make way more volume if more liquidity would have been provided.

Low ratios may say that this market would have done almost the same volume with less liquidity.Market Volume Share Boost Liquidity Volume/Liquidity New Boost Change swth_usdc1 $7.004.444,98 18,61% 18 $1,280,000 3,89% 16 -11,11% eth1_usdc1 $6.853.856,31 18,21% 8 $423,190 12,94% 17 112,50% swth_busd1 $3.861.731,56 10,26% 8 $374,931 8,12% 8 0,00% swth_eth1 $2.952.430,43 7,84% 18 $846,238 3,23% 0 -100,00% busd1_usdc1 $2.760.363,42 7,33% 3 $554,287 1,12% 0 -100,00% nneo2_busd1 $2.409.928,00 6,40% 4 $160,433 10,04% 11 175,00% bnb1_busd1 $2.338.213,53 6,21% 6 $250,985 10,45% 10 66,67% wbtc1_usdc1 $1.834.235,20 4,87% 7 $527,708 3,84% 7 0,00% nneo2_eth1 $1.450.589,42 3,85% 4 $259,523 3,44% 4 0,00% eth1_wbtc1 $1.139.439,94 3,03% 4 $629,206 2,13% 4 0,00% nneo2_usdc1 $968.479,93 2,57% 2 $72,303 7,78% 0 -100,00% bnb1_eth1 $934.906,48 2,48% 6 $356,704 2,95% 5 -16,67% btcb1_busd1 $877.366,82 2,33% 4 $350,795 3,79% 6 50,00% cel1_busd1 $827.083,73 2,20% 3 $155,276 3,49% 4 33,33% cel1_usdc1 $552.667,65 1,47% 2 $127,110 3,84% 0 -100,00% cel_eth $549.008,77 1,46% 2 $114,556 4,39% 3 50,00% wbtc1_btcb1 $242.671,12 0,64% 1 $285,182 0,29% 0 -100,00% nex1_usdc1 $15.295,22 0,04% 0 $1,372 0 0,00% NEW Partnerships - - - - 5 - $37.638.287,28 100 100

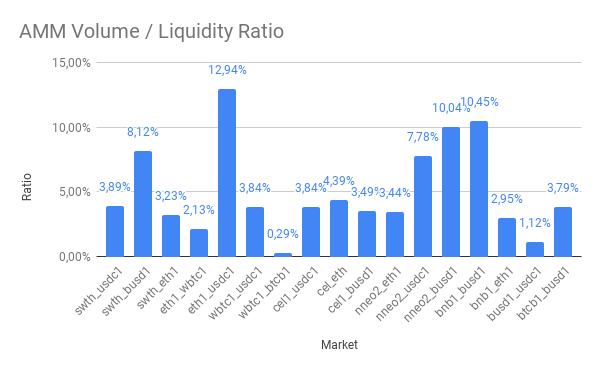

This diagram shows the ratio between the effective AMM volume divided by the liquidity in USD. For example the pair swth_usdc1 has a ratio of 3.89%.

The ratio tells how much volume was produced by the available liquidity over this time. The total AMM volume for swth_usdc1 (SUM Daily AMM Volume) was $6.495.149,00, the total available liquidity(SUM Daily AMM Liquidity Value) was $166.806.223,99.

With other words the ratio is the daily average volume against the available liquidity. The higher the ratio the more volume the pair produced.

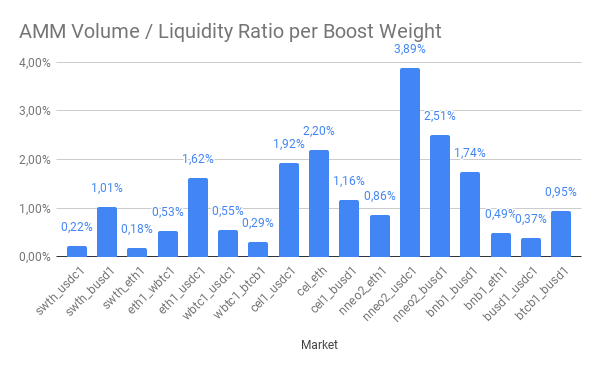

This diagram takes the boost weight into consideration. It simply divides the ratio by the current pool weight. The result says how much volume was produced on daily average per boost weight.

A high ratio indicates that this pair could be doing way more daily volume if there would be more liquidity in the pool.

A low number on the other hand indicates that the pool is performing not that well. The reason has to be investigated.

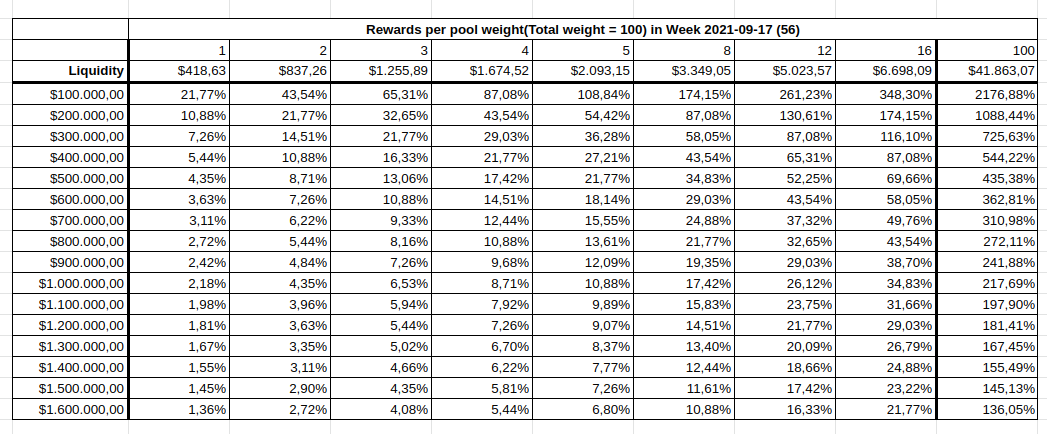

This table(sorry for the picture of a table) shows the expected ARPs per pool weight and liquidity. Last proposal showed that some users did not understand how the ARB is calculated. This is my explanation:The liquidity provider rewards decide how much of the block rewards are distributed to the pools with weightage. For week 2021-09-17(56) a total of ~ 7574623,565 SWTH are created and splitted between Stakers, SDF and LPs.

If in this week the liquidity provider rewards are set to 30% a total of ~2272387,07 SWTH @ $0,01842251 = $41.863,07 + Transactions Fees + Trading Fees will be used to incentive liquidity.As already shown this amount depends on muliple factors. Total SWTH Staked, Current Inflation Week, Current Reward Curve, SWTH price, Transaction and Trading fees as well as their exchange rates.

Next to be considers is how the Reward is split among the pools. For this the pool reward weightage defines a relative share. Like last time I prefer a 100 points system.

This means 1 point equals 1% of the current total reward. In this example 1 point equals $418,63 while 10 points equal $4.186,31.

Simple said: the pool weightage defines a relative share of the total rewards distributed to all providers in the pool.Finally the liquidity in the pools tells how high the current ARB is. A pool with a relative share of 5% receives $2.093,15 in this week. If the pool has $100.000,00 liquidity this brings us to the equation:

ARB = relative shares($) * 52 / liquidity = $2.093,15 * 52 / $100.000,00 = 108,84%

This example shows that the ARB depends an various factors so far. But thats not all.Last but not least the own provided share with the so called boost factor defines how much of the relative share goes into your pocket.

The equation for this is quite simple: Your rewards = your share($) / total liquidity * Total Rewards. The boost just (virtually) increases your share because you locked your liquidity.

BUT if ALL users commit their liquidity at the same time and duration no one profits from the boost, because all users are being boosted by the same factor, resulting in the total liquidity increasing at the same ratio.

Because of this fact I can not take the personal boost in consideration, the personal ARB can be higher or lower depending on other users and their total share and commitment time.Explanation

The following explanations are in order of their corresponding total volume.

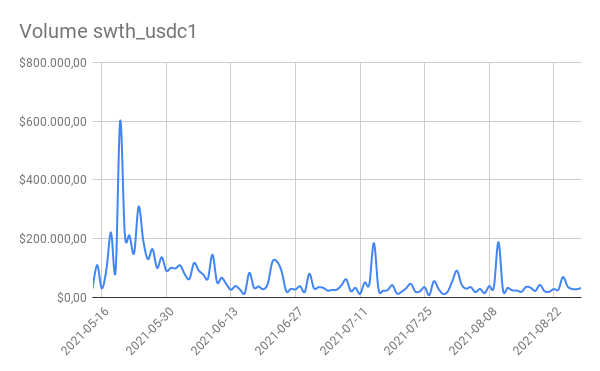

swth_usdc1

Most volume comes from swth_usdc1, this pair has the most AMM liquidity with $1,280,000. Taking a look at the Volume/Liquidity ratio tells that his pair has a medium ratio. Looking at the ratio per boost weight shows something important.

The pool has to much pool weight for the produced volume. Only 0.22% per weight can be expected as volume. As already mentioned in the comments and proofed by data this pool needs adjustment.The problem with this pair is the 80% USDC / 20% SWTH ratio, the pool has $1.020.474,07 USDC but only a fiction is being used. Looking at swth_busd1 shows that it is viable to do a 50%/50% pool.

So chaning the weight a bit down and creating a new poool should improve this problem.eth1_usdc1

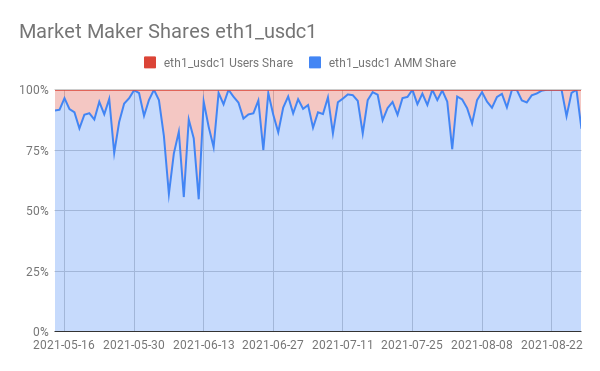

As second most important trading pair a boost of 8% seems quite less. A closer look on the pool shows that this market has a really low liquidity compared to the total volume. This pair has the highest Volume/Liquidity ratio and indicates that we should increase the boost for this pair.

Boosting this market may lead to a significant increase in daily volume. Especially after EIP-1559 has passed, which causes a burn on each block.

swth_eth1

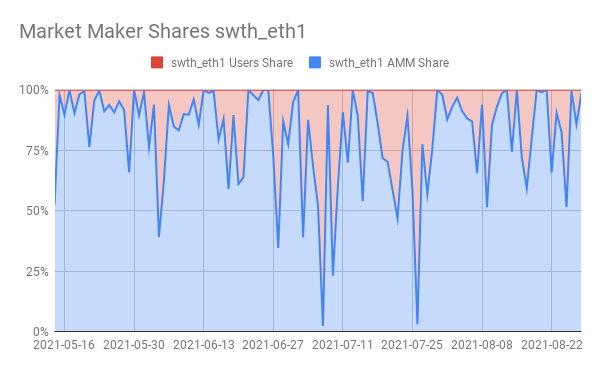

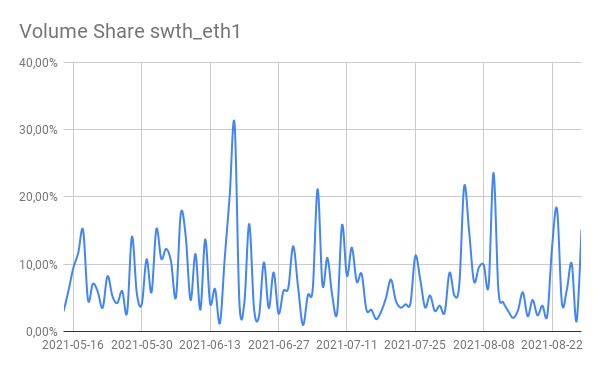

This market has the second biggest Liquidity pool but is performing pretty bad with an Volume/Liquidity ratio of 3,23% and a total boost of 18 points which results in 0.18% per weight. It is the lowest ratio of all boosted pairs. As already suggested in the comments below it is worth to consider dropping the whole boost for this market and promote it external.

I talked with the Switcheo Team, they already gave me their commitment to continue providing liquidity from their end. This guarantees a minimum liquidity for the AMM to continue working.

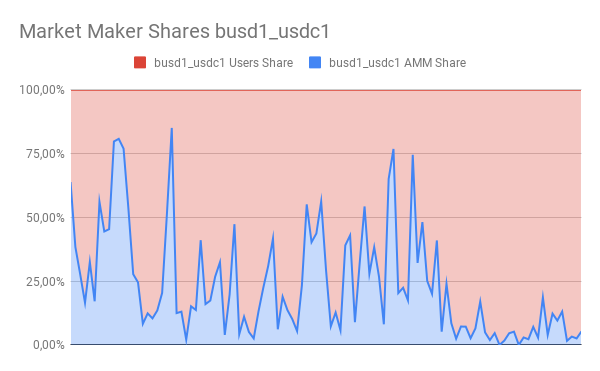

busd1_usdc1

A perfect example for a successful market. A close look at the Market Maker Share shows that this market is almost 100% made by user orders. Due to this fact and that the AMM does not work very well with a stable coin pair removing the boost should not have any impact on the liquidity.

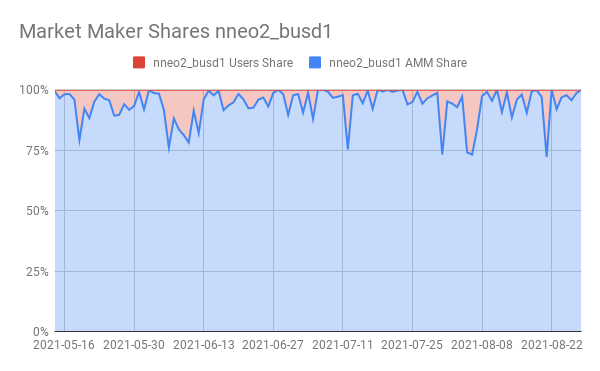

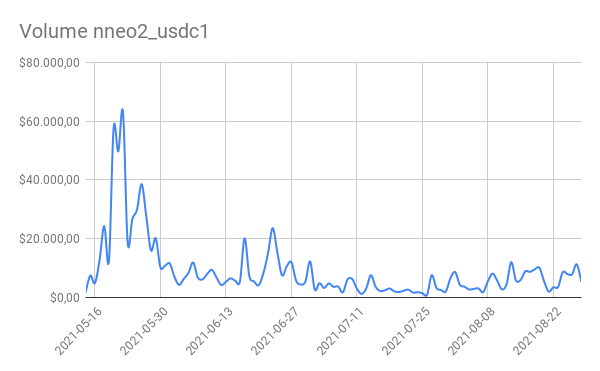

The other metric indicates the same, the AMM do not use much liquidity from pool, due to users outbidding the AMM.nneo2_busd1 and nneo2_usdc1

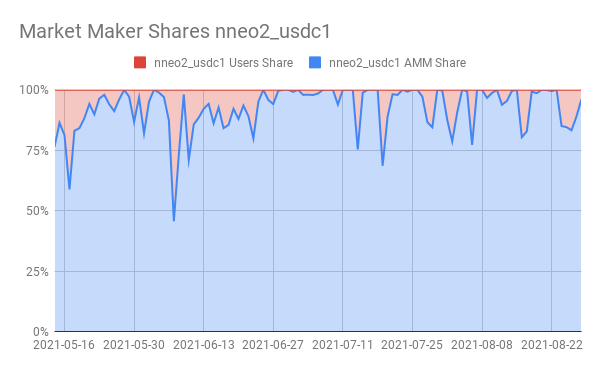

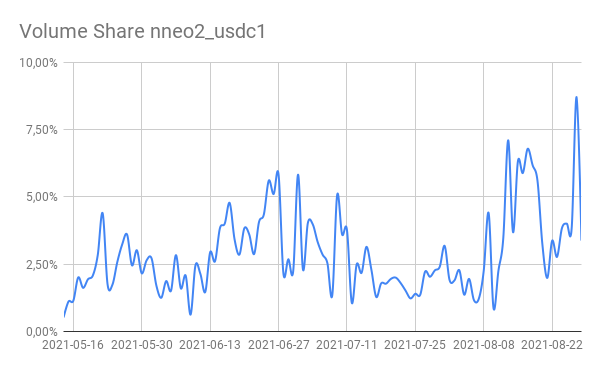

It is insane how much volume those two markets generated with that low liquidity. nneo2_busd1 has a Volume/Liquidity ratio of 10,04% and nneo2_usdc1 7,78%. A closer look at the ratio per weight shows that those two pairs have the highest values among all pairs. Taking this into consideration these two pairs may do way more volume if they would feature more Liquidity.

Thanks to high price movement and triangular arbitrage these pairs performed very good.On the other hand 3 pairs for Neo seems to much right now. Would like to hear more feedback from the community. In my opinion BUSD/NEO is preferred, it is way cheaper to trade across exchanges.

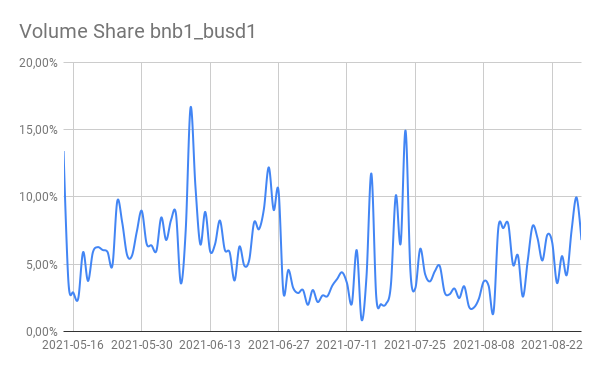

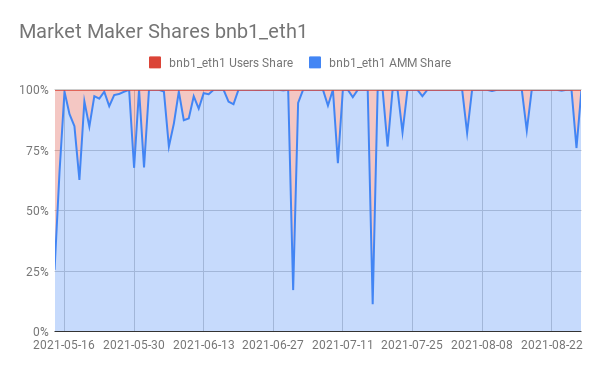

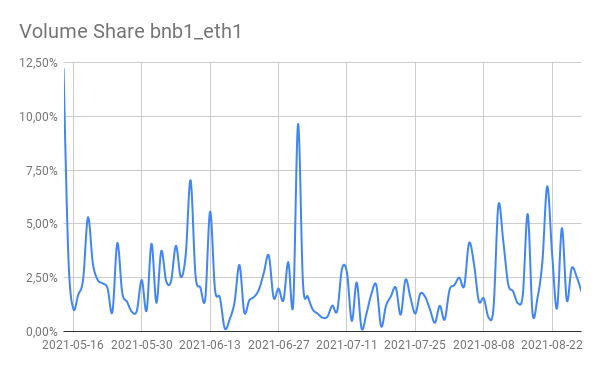

bnb1_busd1 and bnb1_eth1

bnb1_busd1 performed pretty well. There is still potential upwards. Lowering bnb1_eth1 may shift liquidity to bnb1_busd1.

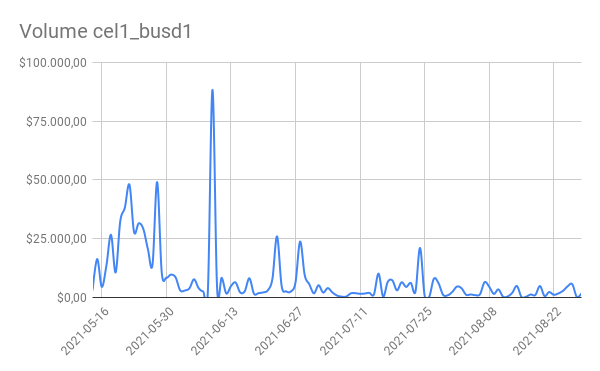

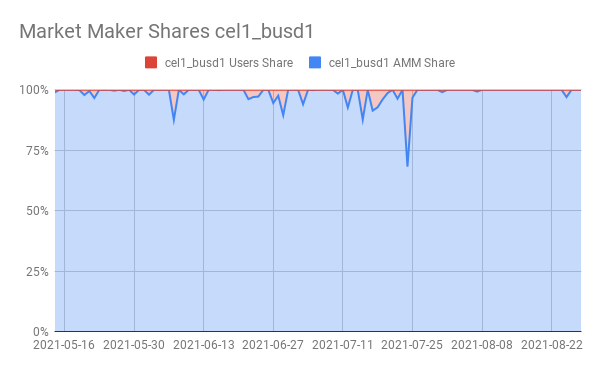

CEL pairs

The cel pairs performed good too, but focusing on one or two pairs could make the deal here.

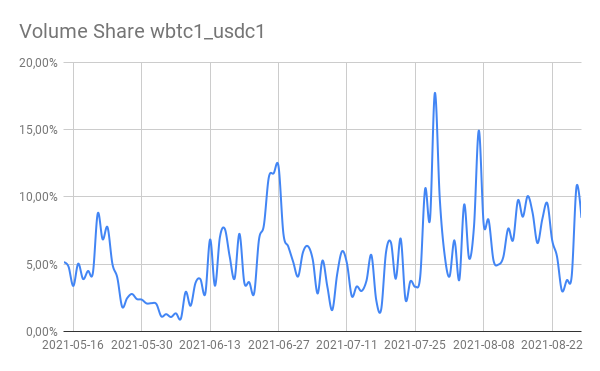

wbtc1_usdc1 VS btcb1_busd1

If you just compare Volume then wbtc1_usdc1 wins. If you look deeper into the data btcb_busd1 wins because it is cheaper. Both tokens are from BSC and therefor the transfer is super cheap compared to two ETH tokens.

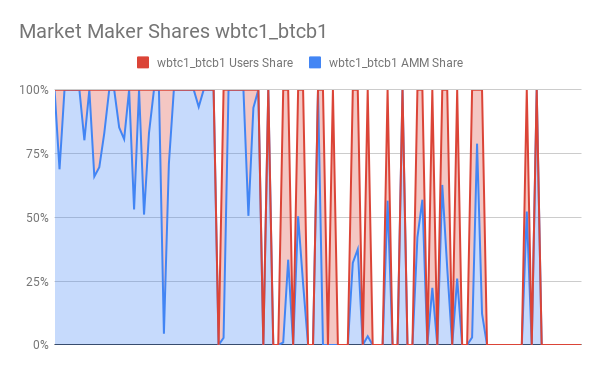

It is my preferred choice to trade BTC. Increasing btcb1_bsud1 and letting wbtc1_usdc1 untouched could increase the volume.wbtc1_btcb1

Not much to say, this pair should be no longer boosted.

Market insights

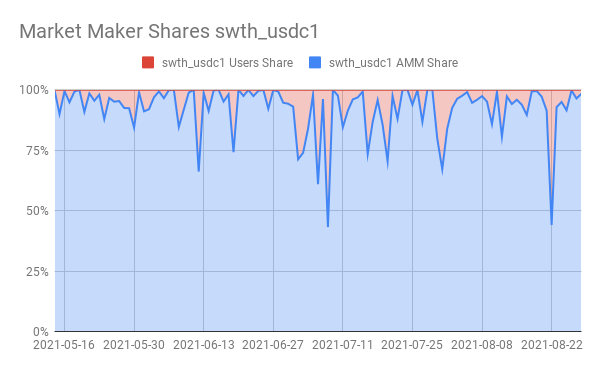

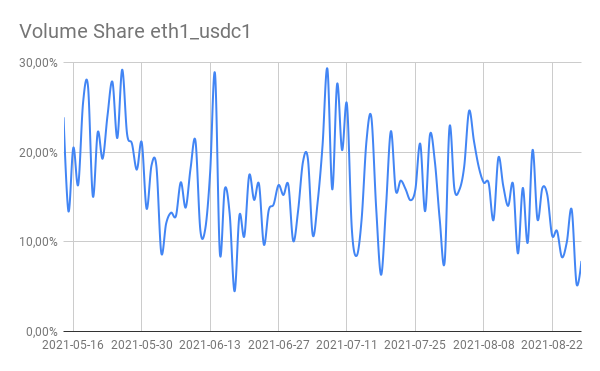

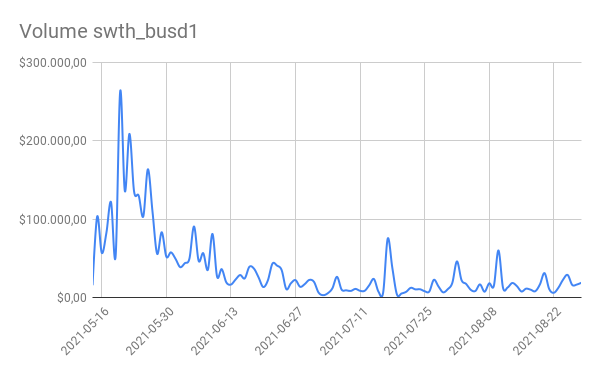

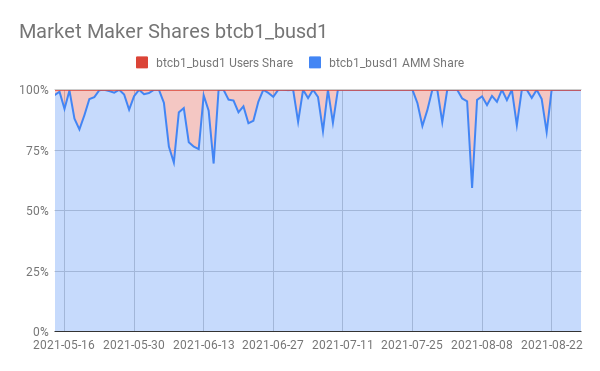

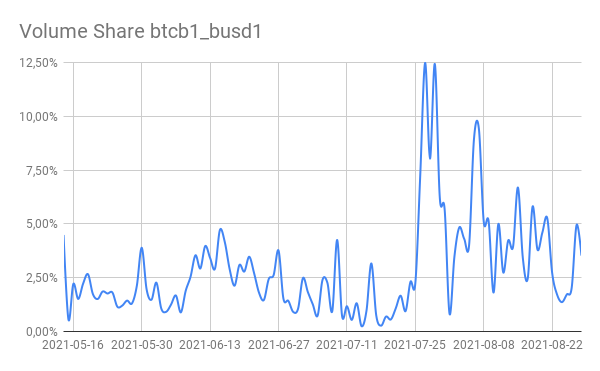

Each market has three diagrams. Each diagram uses the same time duration.

Volume: Shows the daily absolute volume over the period.

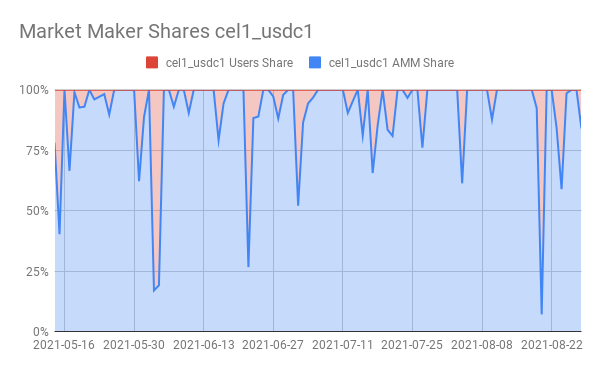

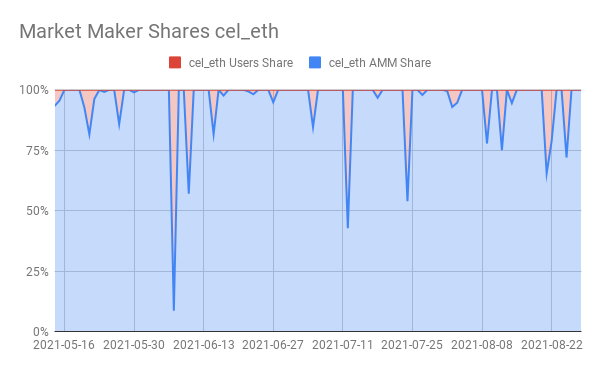

Market Maker Shares - AMM vs. Users: Shows the daily relative maker matched volume over the period. This chart inidcates if an AMM is required for this market or not.

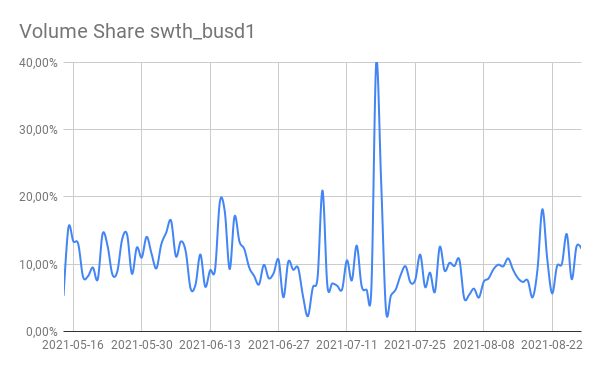

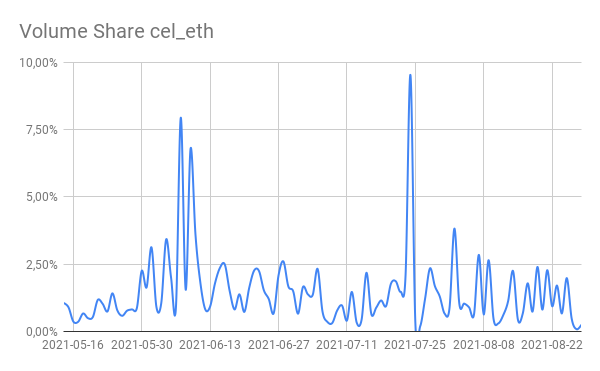

Volume Share: Shows the relative total daily volume over the period.

swth_usdc1

eth1_usdc1

swth_busd1

swth_eth1

busd1_usdc1

nneo2_busd1

bnb1_busd1

wbtc1_usdc1

nneo2_eth1

eth1_wbtc1

nneo2_usdc1

bnb1_eth1

btcb1_busd1

cel1_busd1

cel1_usdc1

cel_eth

wbtc1_btcb1

- Edit1: Removed boosts + added Volume/Liquidity ratio

- Edit2: Re-added boost, updated explanations and added more content

- Edit3: Added clarification about the duration of the proposed pool weight adjustments

- Edit4: spelling + small clarifications

- Edit5: Added Liquidity information over time + adjusted pool weights

-

Great analysis, thanks. Some initial qns:

- Why is

btcb1_busd1still incentivized butcel_busd1not (2.3% volume with weight 4 vs 2.2% volume with weight 3)? - Should we drop swth_eth entirely and move incentives to manual distribution on Sushiswap via SDF? That will build liquidity on ETH L1, making it easier to push SWTH as a collateral on lending platforms, form partnerships, etc.

- Can we have a volume / liquidity ratio column for comparing how effective liquidity is in generating volume?

- Why is

-

-

Drop SWTH/ETH and manually incentivize that on Sushiswap (SWTH/ETH).

-

Drop SWTH/BUSD and manually incentivize that on Pcs (SWTH/BNB).

-

Drop BNB/ETH and BTCB/BUSD.

-

Increase boost for WBTC/USDC and ETH/WBTC.

-

For new partnerships minimum liquidity provided by them should be $500k.

-

-

And once the bridge is live we could list zrc2 tokens like ZWAP and gZil

-

Thank you for sharing the data. Reducing the number of incentivized pairs is a good move so LP's can focus more assets on incentivized pairs and create a better arbitrage opportunity for traders.

CEL Pairs

Reducing Cel boost may result in a loss of 400k in liquidity. Consider leaving one pair with boost.Swth/ETH

This pair has a high impermenent loss risk. Reducing Boost can also affect liquidity.nNeo/USDC/BUSD

Focusing on one pair is a great move. Liquidity has shifted to Neo/BUSD, but it was nice to have Neo paired with USDC since that pair was not available any where else.Consider staying close to the Flamingo Pairs. Since the community are very closely related. A future Gas/USD pair could bring some volume and more choices to traders.

-

First thanks to all already responded. Did not expect that. I had to save the first draft because I ran out of time this day.

While I was writing and interpreting data I already saw that I have to change my proposed adjustments. I will add more content.

-

@ravenxce said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

Why is btcb1_busd1 still incentivized but cel_busd1 not (2.3% volume with weight 4 vs 2.2% volume with weight 3)?

This was one think I realized while writing the this proposal. cel did perform not that bad. But we should definitly focus on 1 or max. 2 pairs. I checked how much triangular did in volume and it was ~ 10-15% total.

@ravenxce said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

Can we have a volume / liquidity ratio column for comparing how effective liquidity is in generating volume?

Will add this, asap. Sadly I just have the current liqudity and not the liquidity at the time of trading.

-

I have updated the proposal to a publish state. Please continue giving feedback. Please focus on the first two sub steps first:

- Extension of the Liquidity Provider rewards

- New Parterships Boost

Since these two steps impact the rest, I want to start a Text proposals for these two prior to the ending of the current rewards.

Thank you

Devel -

2 nNEO pairs with boost should suffice. nNEO/ETH and any 1 of nNEO/BUSD or nNEO/USDC.

1 CEL pair should be enough for boost. I think CEL/BUSD wins because of low network fee on BSC side compared to CEL/ETH and CEL/USDC where both sides are ETH.

I think WBTC/USDC and ETH/WBTC could see an increase in boost a little. Rest all looks fine.

For new partnerships boost, all your points are good but I think minimum liquidity should be $500k and $250k per pair. But I am fine with whatever the consensus is.

-

@nwo said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

For new partnerships boost, all your points are good but I think minimum liquidity should be $500k and $250k per pair. But I am fine with whatever the consensus is.

The more liqudity the better, but I dont think that any medium/major projects will even look at demex(right now). Providing 500k Liquidity is a high threshold for low marketcap projects. Maybe trough the boost they achieve that but not prior too.

Maybe @Coco87 and @seraph_staking can speak for Locklet, could be our first partnership approach to test it.

-

Please note, I provide liquidity to the CEL/USDC/BUSD pairs, depending on how bonuses are decided, this will definitely decide on how I will proceed here. I also provide LP for CEL/ETH on uniswap. If there are CEL/ETH bonuses added I will strongly thing about moving that LP here.

-

-

Thanks for the proposal. Here are some current questions:

-

My main concern would be with the swth_usdc pool - this pool is actually currently 80% USDC. At current SWTH prices, awarding 16 points to it is basically a super high USD yield farm. The volume/liquidity ratio is also quite low as compared to swth_busd. Seems to suggest liquidity is wasted. I suggest we could either: a) create a new 50-50 pool and reward that, or b) drop the weightage for that pool such that the resultant APR will be closer to stablecoin pools.

-

There are multiple NEO pools being rewarded. When the protocol supports Neo3, what is the plan here? I think we should decide now if we are going to a) move rewards, b) split rewards, or c) treat Neo3 pools as new additional pools with rewards to be reconsidered.

-

I think we can give more weight to the partnership idea, it is worth a shot to get more users on the protocol. Not a big concern though, as we can also just increase it later by not restricting to 5 points (so total > 100) if it works well.

By the way, if we could have a column with the current APRs, that would be great, so we can eyeball what the new figure would look like.

-

-

@ravenxce USDC/SWTH 50-50 pool is a very good idea in my opinion, i'd definately join that pool.

-

@ravenxce @nwo @PlanD @CoolCash @Coco87 @acidbird

Thanks to @intsol we were able to reproduce the exact amount of liquidity at any time in the past. I changed the Volume/Liquidity ratio to Total AMM Volume / Total AMM Liquidty indicating how much volume the AMM produced at the total liquidity available over the time.

I also added new tables and diagrams. The linked spreadsheet contains way more information. Due to the fact that the post is already extremly long I just reference the sheet.

@ravenxce said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

My main concern would be with the swth_usdc pool - this pool is actually currently 80% USDC. At current SWTH prices, awarding 16 points to it is basically a super high USD yield farm. The volume/liquidity ratio is also quite low as compared to swth_busd. Seems to suggest liquidity is wasted. I suggest we could either: a) create a new 50-50 pool and reward that, or b) drop the weightage for that pool such that the resultant APR will be closer to stablecoin pools.

Yes definitly. We should create a new pool and link it to the market asap. Question: Is the protocol able to handle two pools linked to the same market, this would allow us to make a clean transfer.

@ravenxce said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

There are multiple NEO pools being rewarded. When the protocol supports Neo3, what is the plan here? I think we should decide now if we are going to a) move rewards, b) split rewards, or c) treat Neo3 pools as new additional pools with rewards to be reconsidered.

As soon as Tradehub supports N3 and most other exchanges start using N3 we should change all Neo pools to N3 pools and drop the old one. As far as I know the NEO team tries to motivate all users to shift to N3.

@ravenxce said in [TIP-16] Extension of LP Rewards & Updating of Pool Weights:

I think we can give more weight to the partnership idea, it is worth a shot to get more users on the protocol. Not a big concern though, as we can also just increase it later by not restricting to 5 points (so total > 100) if it works well.

I added the a ARB table for pool weights + provided liquidity. Locklet (@Coco87 + @seraph_staking ) already showed their intrest in providing atleast 100k. Lets see and try out I would say.

And sorry for the many changes and tagging. But collection and processing that much of data (few gigabytes of data) took a lot of time + effort. I had to develop few helping tools

-

Hi Devil and others! Great job, and very good that you started this threat. Already a lot is said about the weight, and the efficiency. I focussed my feedback on other aspects. In my opinion, the success of this proposal is not only in adjusting weights, and creating other pools. It’s depends on the ability to close new (strategic) partnerships. And also in the follow up. What triggers me is that we are talking about ‘partnerships’. Besides Locklet we don’t have any, yet. In my opinion this proposal is very much needed, to be able to successful work towards these partnerships.

Quite some text, excuse me in advance, English is not my native language. I’ll follow your 3 sub-proposals first.

- Extension of the Liquidity Provider rewards: It’s a yes for me. Personally I think the percentages could be a bit higher, regarding the upcoming 100-listings and the need to provide a decent bootstrap. On the other hand, more than 30% would lead to new discussions. Let’s keep the max on 30%.

- New Partnerships Boost: It’s a yes for me. The main goal of liquidity pools is to create volume. Volume leads to fees, fees lead to rewards (value) for swth-stakers. It also leads to fair changes that your sell/buy order gets filled (small slippage), so it makes Demex function as it should. So, all good. The proposal fits the purpose. See below more feedback, also on the bullet “Telegram + Twitter promotion".

- Pool weight adjustment: It’s a yes for me as it is presented at this moment. We need to keep the discussion live and open during the next months.

Besides this feedback…

Getting to more volume

Only full juicy ordersbooks is not enough to generate volume. We need (automated) Market Makers: meaning (new) active traders and/or arbitrage bots. Attracting new traders is something I guess we don’t need to discuss in this thread (chicken-egg). What I’d like to address is better organizing (automated)MM, more specific arbitrage bots, to serve Demex. There are currently not much people running arbitrage bots. And I guess the bot with the lowest profit-% will take all the opportunities. I assume the profit-% is small, but with future expected high(er) volume over a longer period of time, it will be significant. I would like to see the a-bot profits to further strengthen the value proposition of Demex. Mabey this is very easy, if an a-bot would run with, for example, a 95% chance on an average of 0% profit, and would therefor only run to create volume. Or mabey it takes more, like adding a-bots whose profits flow into liquidity pools, or are used to buy and burn SWTH/other LP-token.Take into account a min. amount to perform an action due to the requirement of fees.Getting to (strategic) partnerships

Besides the suggested basics numbers for liquidity we need to think about: 1) how do we even get to new partnership and 2) after closing a partnership, how do we keep momentum high and the buzz going. You could call it marketing/promotion for Demex, for Switcheo, and for the Partner. I cant help myself to spit out some thoughts, because I think we need to put thoughts on this matter at this point aswell. This proposal serves future partnerships.How do we get to new partnerships:

I think we need to have a good proposition to get partners involved and we really have to sharpen this item. I guess we all do. So, why would partners get involved with us, in stead of competitors? I think the main benefits for them should be financial and exposure (to satisfy their token holders), ideal also collaboration in knowledge development, knowledge exchange, product development and integrating partners services. Okay, so how? How do we get to partnerships? Not limiting myself with technical aspects, some suggestions:Assumption: the client to close a partnership with is a professional organisation/businesspartner.

- We could work with a referral code for new partners, so they are more likely to get their community members to open Demex-accounts, deposit and do trades (partner gets % of the fee during the first x-period or time).

- I hope we can increase the min. required liquidity, but on the other hand, Demex doesn’t have the position (yet) to set a very high min. rate. For smaller businesses the min. liquidity is likely to be to difficult (see the feedback of Coco/Locklet). In order to get new partners on board, we could offer partnership-packages. Basic, Regular, Extra. Variation in especially min. Liquidity and mabey also duration/time and joint-exposure. Especially for smaller businesses, we counter-offer exposure and availability (see below).

- We should at all times prevent the image “we have to pay for a partnership”, so clearly point out the mutual benefits.

- Is there room to think about a business/commercial account manager, or sales person, assigned by Switcheo? Working on a reward base? Or is this something community-members should do (regarding decentralisation)? Rewards could be paid from the SDF.

- We can assume our competition will react, mabey copy and improve our approach. Def. need more thoughts about long-term relations and binding our partners...

Make other communities aks for a Demex partnership/collaboration

It would be great to get communities of other businesses/projects to start organizing a partnership (Demex-listing and liquidity-pooling) themselves. It fits the decentralized vision. Or at least to get them asking, or even begging , the teams/projects they support to start getting them listed on Demex. Their community members are suddenly turned into our salespersons, and do our aquisition. It would be great to find some sort of financial benefit to incentify community members to do so. Some ideas:

, the teams/projects they support to start getting them listed on Demex. Their community members are suddenly turned into our salespersons, and do our aquisition. It would be great to find some sort of financial benefit to incentify community members to do so. Some ideas:- Again: referrals.

- Use a % of the tradingfees to buy the partners token (increase demand). What to do with these tokens after required needs more thought (put into LP, lock, burn,…). Take into account a min. amount to perform an action due to the requirement of fees.

- The current pro's of Demex (low fees, dex, complex orders, no kyc, orderbooks, no deposit/withdraw limits, etc).

- Current business associates can provide valuable input...

“Telegram + Twitter promotion":

Yes, we/team can and should offer to work (together) on joint exposure. Basic: reviews about our partner and the type of collaboration, and the channels we use (twitter/medium/reddit/etc.).We provide the new partner and the partnership with regular joint-exposure, and how it benefits both parties (and therefor also swth-holders). We could also offer 'Ask Me Anything' sessions, and so on. These reviews can be written by Switcheo Labs, a 3th party, or by a community member. We can even ask community members to make NFT's (like the swth-comic). Thought: we can pay people 50% with the partners-tokens and 50% in SWTH (from the Switheo Development Fund). And yes, our partner needs to do promotion with the same intensity and goal.Last item...

Out of the box: for each trade made, a % of the fee goes to a Liquidity Pool Bootstrap Fund. This bootstrap fund invests in Liquidity Pools. This fund grows over time. How and what to do with it needs more thinking. Seems a small amount at this time, can be significant when volume really picks up. This needs math.Take into account a min. amount to perform an action due to the requirement of fees.Thanks everyone for taking the time to read all of the above. I know, not everyting is related to the original threat by Devil. But his threat led to the thoughts above, so somehow it's all related. At least I'd like to think...

-

Since now SWTH/USDC is 50-50 same as SWTH/BUSD 50-50:

Should remove rewards from SWTH/BUSD and add that to SWTH/USDC - Total 24 Boost (Those coming from BUSD to buy SWTH have the USDC/BUSD pair).

OR

Make SWTH/USDC and SWTH/BUSD equal boost of 12 each.

Having different weight for 50 SWTH - USDC 50 and 50 SWTH - BUSDC 50 makes no sense since both are 50-50 and essentially stable coin.